We’ll tell you how to easily carry out freight transport from China to the United States, what documents you’ll need for this, and what international rules govern such operations.

The first thing you need to know is that your supplier in China must have an export licence, which allows them to send certain types of goods abroad. Without this document, customs will not let the goods through (meaning you risk incurring substantial losses). It is also impossible to issue a Chinese VAT refund without it. Therefore, when you start working with a new manufacturer, always ask if they have such a permit.

Quite often, small companies do not want to pay additional state duties and deal with the collection of additional documentation, so they do not apply for the right to export their products.

If you have found such a manufacturer and are ready to cooperate, the easiest way to solve the “documentary issue” is to contact an intermediary company that already has a Chinese export licence.

Such companies can act as a contract holder (i.e. you get the opportunity to work with several suppliers under a single contract). Yes, you will have to pay a lot for such services, but it can be cost-effective, given that Chinese manufacturers often charge much lower prices than their competitors.

So, we’ve figured out that you and the seller will need an export licence first. What else is on the list?

We will write a complete package at once, which you will need not only for export from China, but also for importation into the territory of other countries:

You may also be asked to provide a customs declaration, invoices, packing list, transaction passport, and much more, depending on the product category and the “strictness” of the particular country of import. However, for China-US transactions, you will only need to have transport, commercial and customs documents from the above list.

The list is similar, with the only caveat that when importing products into the United States, it is important not only to prove the legitimacy of the transaction, but also to pay the country’s taxes correctly.

For this purpose, HS codes are used – with the help of this classifier, the authorities estimate the amount of duty and control imports.

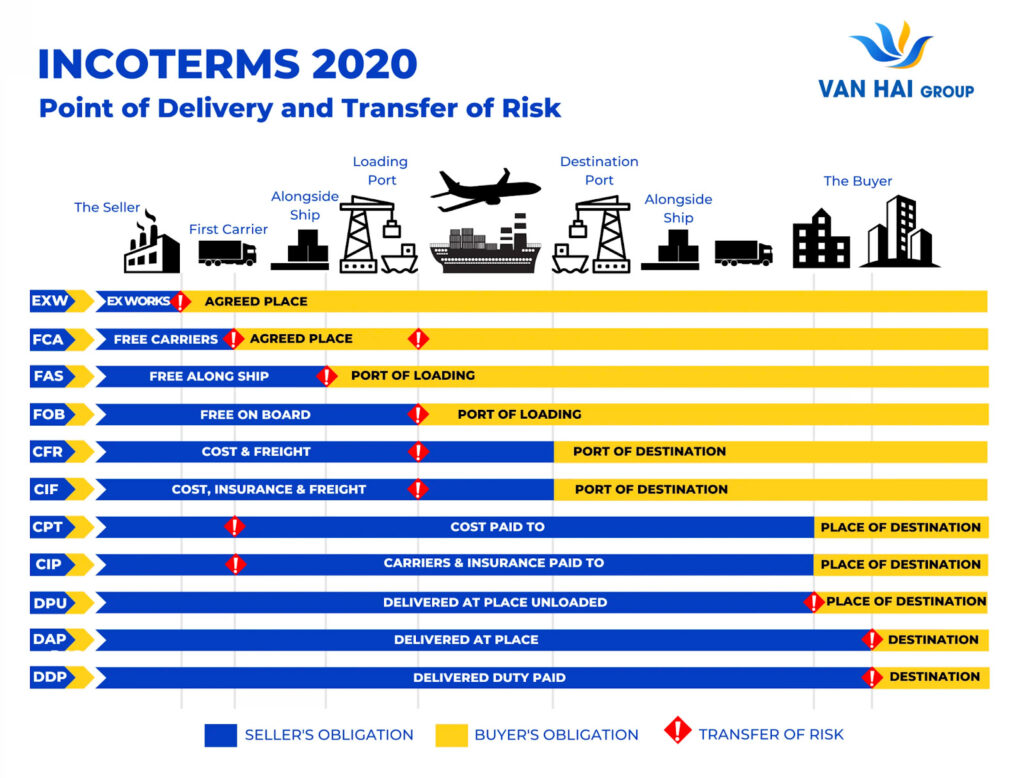

Incoterms rules exist to determine such nuances.

Thus, according to the EXW rule, you, as the buyer, are obliged to pick up the goods from the factory/warehouse and further deal with their domestic or international transportation, including all costs and operations related to this.

However, under the DAT rule, the seller is obliged to pay not only for the carriage, but also for export duties and insurance, and to deliver the goods to the import customs terminal.

In total, 11 such terms have been developed and updated (every 10 years) by the International Chamber of Commerce. That is, they are the same for international transport in all directions, not only China-USA, but also, for example, Australia-Ukraine.

We advise you to read them if you want to thoroughly understand the terms of transport contracts and make a decision on your own, without the support of specialists, on which Incoterms rule will be more beneficial for you to negotiate with Chinese manufacturers.